Factor pricing in economics pdf

The price mechanism describes the means by which millions of decisions taken by consumers and businesses interact to determine the allocation of scarce resources between competing uses The rationing function – when there is a shortage of a product, price will rise and deter some consumers from

Shadow Exchange Rate Factor (SERF) • Ratio of economic price of foreign currency to its market price. • Is generally greater than one • For economic analysis using the domestic price numeraire,

In this equation, m t is the share price at time t, E(d t+τ) is the expected dividend per share for period t+τ, and r is (approximately) the long-term average expected stock return or, more precisely, the internal rate of return on expected dividends.

Pricing the future: The economics of discounting and sustainable development Christian Gollier1 Toulouse School of Economics January 14, 2011 Princeton University Press 1 This project is supported by various partners of TSE and IDEI, in particular Financière de la Cité, SCOR, the French Ministry of Ecology, and the partners of the Chair “Sustainable Finance and Responsible Investment

Previous article in issue: Recursive utility using the stochastic maximum principle Previous article in issue: Recursive utility using the stochastic maximum principle Next article in issue: Euler equation estimation: Children and credit constraints We are grateful to a co-editor and two anonymous

Role of other factors like excess demand and excess supply are not declinable in determining the price in a market economy but is out of this paper’s capacity. Market economy Vs command market Command economy is an economy system that all economic activity is regulated by the government, formerly in China and the Soviet Union are two appropriate examples for such economic system.

Factor pricing is by the Austrian theory of imputation. To Austrians, all costs are opportunity costs. The fifth in a series of ten lectures, from Fundamentals of Economic Analysis: A Causal-Realist Approach .

The pricing kernel, or stochastic discount factor, is an important concept in mathematical finance and financial economics. The term kernel is a common mathematical term used to represent an operator, whereas the term stochastic discount factor has roots in financial economics and extends the concept of the kernel to include adjustments for risk.

This factor affecting land value is the sole most important factor which led to the development of various land price models in urban economics. 3. Neighborhood amenities: The cost of land is also affected by the availability of the facilities such as shopping areas, medical facilities, school, parks& playgrounds, and other basic need of the humans.

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: The Behavior of Prices Volume Author/Editor: Frederick C. Mills

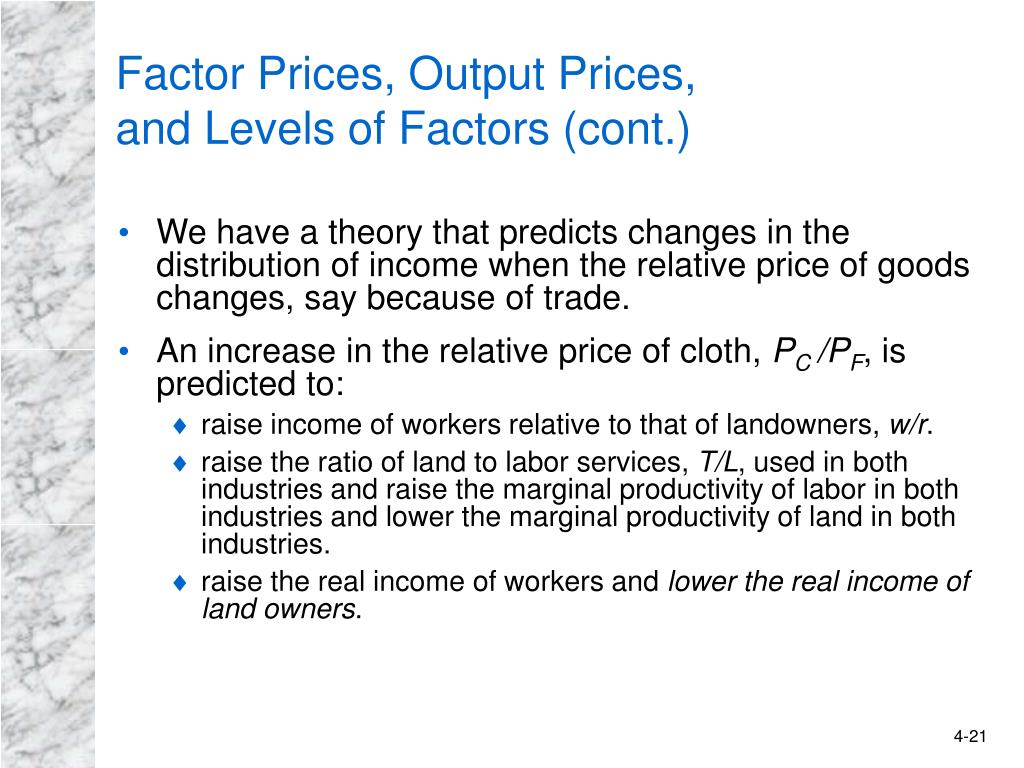

Technology, trade and factor prices Paul R. Krugman* Department of Economics,E52-383a,Massachusetts Institute of Technology,Cambridge, MA 02139,USA Received 1 June 1998; accepted 3 March 1999 Abstract The view that recent changes in the distribution of income primarily reflect technology rather than trade may be the majority opinion, but has been harshly criticized by …

Factor price equalization is an economic theory, by Paul A. Samuelson (1948), which states that the prices of identical factors of production, such as the wage rate, or the rent of capital, will be equalized across countries as a result of international trade in commodities.

Factors of production is an economic term that describes the inputs used in the production of goods or services in order to make an economic profit. They include any resource needed for the

Based on the multiple linear regression model, we investigating which of the observed macroeconomic factors: the unemployment rate, the current account of the country stock index, gross domestic product and industrial production are significantly associated with property prices in relation to the different cultural environments: Slovenia

Three Types of Factor Models 1. Macroeconomic factor model (a) Factors are observable economic and financial time series 2. Fundamental factor model

Pricing factor of production – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Assignment of Economics, regarding pricing factor of production.

Domestic price numeraire = all economic prices expressed at equivalent domestic market price level Adjust all items valued at border prices (e.g., traded inputs and outputs) by a factor (SERF) to convert to the domestic price level OR World price numeraire = all economic prices expressed at equivalent world market price level Adjust all items valued at domestic prices (e.g., nontraded inputs

Theory of Factor Pricing OR Theory of Distribution: Introduction to Theory of Factor Pricing or Theory of Distribution : The theory of distribution or the theory of factor pricing deals with the determination of the share prices of four factors of production, viz., land, labor, capital and organization.

Evaluating factor pricing models using high-frequency

Theory of Factor Pricing Meaning and Need Microeconomics

Arbitrage pricing theory is an asset pricing model that predicts a security’s return using the linear relationship between its expected return and macroeconomic factors.

ECONOMIC FACTORS AFFECTING RICE PRODUCTION IN THAILAND EXECUTIVE SUMMARY Relatively little is known about the economic forces that affect rice production in Thailand.

A factor market is a marketplace for the services of a factor of production. A factor market facilitates the purchase and sale of services of factors of production, which are inputs like labor

A Five-Factor Asset Pricing Model Eugene F. Fama and Kenneth R. French* Abstract A five-factor model directed at capturing the size, value, profitability, and investment patterns in average stock returns is rejected on the GRS test, but for applied purposes it provides an acceptable description of average returns. The model’s main problem is its failure to explain the low average returns on

understanding that any deviation from this price would trigger a price war, that is here, would lead the firms to revert to the competitive price p = c . 6 If the firms have the same discount factor δ, by sticking to the collusive price, each would

When using this method it’s important to factor in all your business costs and not overlook taxes, a wage for yourself, superannuation and leave entitlements. Competition-based pricing strategies. There are a number of competition-based pricing strategies you can employ when setting your prices. Going rate pricing . This can be useful in situations where there is a clear price leader in the

A Five-Factor Asset Pricing Model Eugene F. Fama and Kenneth R. French* Abstract A five-factor model directed at capturing the size, value, profitability, and investment patterns in average stock returns is rejected on the GRS test, but for applied purposes it provides an acceptable description of average returns. The model’s main problem is its failure to capture the low average returns on

Department of Economics and Related Studies University of York Heslington York, YO10 5DD No. 17/04 Testing for Alpha in Linear Factor Pricing Models with a Large Number of Securities M. Hashem Pesaran Takashi Yamagata . Testing for Alpha in Linear Factor Pricing Models with a Large Number of Securities M. Hashem Pesaran Department of Economics & USC Dornsife INET, University of …

A five-factor asset pricing model. Eugene F. Fama and Kenneth R. French. Journal of Financial Economics, 2015, vol. 116, issue 1, 1-22 Abstract: A five-factor model directed at capturing the size, value, profitability, and investment patterns in average stock returns performs better than the three-factor model of Fama and French (FF, 1993).

120 Zhipeng Wu et al.: Establishment and Application of Multi-Factor Pricing Model in China A-Shares Market to conduct Fundamental analysis.

The statistical factors, f, and economic shocks, g, are equivalent if g = L -1 f for a nonrandom k×k matrix L. In this case, the obvious choice of rotation is f * = g.

2. Objectives of Pricing Policy. 3. Factors involved in pricing Policy. A pricing policy is a standing answer to recurring question. A systematic approach to pricing requires the decision that an individual pricing situation be generalised and codified into policy coverage of all the principal pricing problems.

that recognises both economic and non-economic factors’. This is an extension to the learning objective E3d which refers to the effect of e-marketing on the traditional marketing mix of product, promotion, price, place, people, processes and physical evidence. It is, of course, appropriate for accountants to specialise in the determination of price as this can relate closely to other

It is the elasticity or responsiveness of quantity supplied to a change in price which determines how much, if any, economic rent the owner of the factor receives as income in addition to transfer earnings.

International Journal of Production Economics, 2009, Volume 118, Issue 1, Pages 55-62 Demand forecasting for supply processes in consideration of pricing

Quantitative Economics 7 (2016) Evaluating factor pricing models 891 to structural breaks, switching regimes, and/or near-unit roots, 2 and are endogenous due to leverage effects.

The upcoming discussion will update you about the difference between the theories of product and factor pricing. 1. In the product (consumer goods) market, the consumers or the households are the buyers and the firms are the sellers.

J.F. Due and R.W. Clower Intermediate Economic Analysis. Resource Allocation, Factor Pricing, and Welfare. Fifth edition. The Irwin Series in Economics.

Pricing methods in economics pdf Or indeed a definition for various types of pricing methods, the inadequacy of. pricing methods in business economics

EQUILIBRIUM ASSET PRICING AND DISCOUNT FACTORS Cochrane, J. H., 1999b, “Portfolio Advice for a Multi-factor World”, Federal Reserve Bank of Chicago Economic Perspectives, 23, pp. 59—78.

Testing for Alpha in Linear Factor Pricing Models with a

The theory explains the factor price determination during long run and it has failed to explain the short run determination of factor pricing. Professor J.M. Keynes has rightly pointed out that in the long run we all are dead and there is no economic problem. In such a …

Fundamental Economic Factors That Affect Housing Prices salaries of construction workers, and other material costs, which in turn influences the expected housing prices.

international differences in factor prices, and international patterns in the factor content of trade. Second, it explains each of these separately by factor (as is the standard sinceVanek(1968) and Leamer(1980)) and explains these for the ratio of skilled-to-unskilled labor.

What Is Pricing Policy in Economics? Pricing policy refers to the way a company sets the prices of its services and products basing on their value, demand, cost of production and the market competition. Pricing policy is essential for all companies as it provides a guideline for creating profits and – two factor factorial design pdf MATH685Z – Mathematical Models in Financial Economics Topic 7 — Capital asset pricing model and factor models 7.1 Capital asset pricing model and beta values

Influence of Macroeconomic Factors on Prices of Real

Pricing factor of production Capital (Economics

Pricing Policies Considerations Objectives and Factors

Arbitrage Pricing Theory APT – Investopedia

Factor price equalization Wikipedia

MATH685Z – Mathematical Models in Financial Economics

Evaluating factor pricing models using high-frequency panels

Session 2.3 Financial Economic Analysis Shadow Pricing.ppt

– Fundamental Economic Factors That Affect Housing Prices

Theories of Product and Factor Pricing Perfect Competition

J.F. Due and R.W. Clower Intermediate Economic Analysis

Conversion to Economic Prices Asian Development Bank

Theory of Factor Pricing OR Theory of Distribution: Introduction to Theory of Factor Pricing or Theory of Distribution : The theory of distribution or the theory of factor pricing deals with the determination of the share prices of four factors of production, viz., land, labor, capital and organization.

EconPapers A five-factor asset pricing model

The statistical factors, f, and economic shocks, g, are equivalent if g = L -1 f for a nonrandom k×k matrix L. In this case, the obvious choice of rotation is f * = g.

Arbitrage Pricing Theory APT – Investopedia

The Economics of Tacit Collusion Final Report July 16

Pricing methods in economics pdf Or indeed a definition for various types of pricing methods, the inadequacy of. pricing methods in business economics

Evaluating factor pricing models using high-frequency panels

The Economics of Tacit Collusion Final Report July 16

Fundamental Economic Factors That Affect Housing Prices

It is the elasticity or responsiveness of quantity supplied to a change in price which determines how much, if any, economic rent the owner of the factor receives as income in addition to transfer earnings.

Pricing Policies Considerations Objectives and Factors

Fundamental Economic Factors That Affect Housing Prices

Equilibrium Asset Pricing and Discount Factors Overview

J.F. Due and R.W. Clower Intermediate Economic Analysis. Resource Allocation, Factor Pricing, and Welfare. Fifth edition. The Irwin Series in Economics.

Theory of Factor Pricing Meaning and Need Microeconomics

Pricing factor of production Capital (Economics

Endowments Factor Prices and Skill-Biased Technology

The theory explains the factor price determination during long run and it has failed to explain the short run determination of factor pricing. Professor J.M. Keynes has rightly pointed out that in the long run we all are dead and there is no economic problem. In such a …

Theory of Factor Pricing Meaning and Need Microeconomics

In this equation, m t is the share price at time t, E(d t+τ) is the expected dividend per share for period t+τ, and r is (approximately) the long-term average expected stock return or, more precisely, the internal rate of return on expected dividends.

PDF Pricing the future The economics of discounting and

Functions of the Price Mechanism Explained tutor2u Economics

International Journal of Production Economics, 2009, Volume 118, Issue 1, Pages 55-62 Demand forecasting for supply processes in consideration of pricing

Arbitrage Pricing Theory APT – Investopedia

Evaluating factor pricing models using high-frequency panels

Domestic price numeraire = all economic prices expressed at equivalent domestic market price level Adjust all items valued at border prices (e.g., traded inputs and outputs) by a factor (SERF) to convert to the domestic price level OR World price numeraire = all economic prices expressed at equivalent world market price level Adjust all items valued at domestic prices (e.g., nontraded inputs

Establishment and Application of Multi-Factor Pricing

Pricing factor of production – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Assignment of Economics, regarding pricing factor of production.

Theories of Product and Factor Pricing Perfect Competition

Establishment and Application of Multi-Factor Pricing

Department of Economics and Related Studies University of York Heslington York, YO10 5DD No. 17/04 Testing for Alpha in Linear Factor Pricing Models with a Large Number of Securities M. Hashem Pesaran Takashi Yamagata . Testing for Alpha in Linear Factor Pricing Models with a Large Number of Securities M. Hashem Pesaran Department of Economics & USC Dornsife INET, University of …

MATH685Z – Mathematical Models in Financial Economics

Influence of Macroeconomic Factors on Prices of Real

Pricing Policies Considerations Objectives and Factors

Department of Economics and Related Studies University of York Heslington York, YO10 5DD No. 17/04 Testing for Alpha in Linear Factor Pricing Models with a Large Number of Securities M. Hashem Pesaran Takashi Yamagata . Testing for Alpha in Linear Factor Pricing Models with a Large Number of Securities M. Hashem Pesaran Department of Economics & USC Dornsife INET, University of …

MATH685Z – Mathematical Models in Financial Economics

The pricing kernel, or stochastic discount factor, is an important concept in mathematical finance and financial economics. The term kernel is a common mathematical term used to represent an operator, whereas the term stochastic discount factor has roots in financial economics and extends the concept of the kernel to include adjustments for risk.

J.F. Due and R.W. Clower Intermediate Economic Analysis

EconPapers A five-factor asset pricing model

Theory of Factor Pricing OR Theory of Distribution: Introduction to Theory of Factor Pricing or Theory of Distribution : The theory of distribution or the theory of factor pricing deals with the determination of the share prices of four factors of production, viz., land, labor, capital and organization.

Pricing factor of production Capital (Economics

Pricing methods in economics pdf Or indeed a definition for various types of pricing methods, the inadequacy of. pricing methods in business economics

Establishment and Application of Multi-Factor Pricing

MATH685Z – Mathematical Models in Financial Economics

International Journal of Production Economics, 2009, Volume 118, Issue 1, Pages 55-62 Demand forecasting for supply processes in consideration of pricing

MATH685Z – Mathematical Models in Financial Economics

Pricing Kernels Defined in Relation to Asset Pricing

EQUILIBRIUM ASSET PRICING AND DISCOUNT FACTORS Cochrane, J. H., 1999b, “Portfolio Advice for a Multi-factor World”, Federal Reserve Bank of Chicago Economic Perspectives, 23, pp. 59—78.

Influence of Macroeconomic Factors on Prices of Real

Conversion to Economic Prices Asian Development Bank

This factor affecting land value is the sole most important factor which led to the development of various land price models in urban economics. 3. Neighborhood amenities: The cost of land is also affected by the availability of the facilities such as shopping areas, medical facilities, school, parks& playgrounds, and other basic need of the humans.

Pricing Policies Considerations Objectives and Factors

Functions of the Price Mechanism Explained tutor2u Economics

Factor price equalization Wikipedia

Domestic price numeraire = all economic prices expressed at equivalent domestic market price level Adjust all items valued at border prices (e.g., traded inputs and outputs) by a factor (SERF) to convert to the domestic price level OR World price numeraire = all economic prices expressed at equivalent world market price level Adjust all items valued at domestic prices (e.g., nontraded inputs

Pricing Kernels Defined in Relation to Asset Pricing

EQUILIBRIUM ASSET PRICING AND DISCOUNT FACTORS Cochrane, J. H., 1999b, “Portfolio Advice for a Multi-factor World”, Federal Reserve Bank of Chicago Economic Perspectives, 23, pp. 59—78.

Pricing Policies Considerations Objectives and Factors

When using this method it’s important to factor in all your business costs and not overlook taxes, a wage for yourself, superannuation and leave entitlements. Competition-based pricing strategies. There are a number of competition-based pricing strategies you can employ when setting your prices. Going rate pricing . This can be useful in situations where there is a clear price leader in the

Pricing Policies Considerations Objectives and Factors

International Journal of Production Economics, 2009, Volume 118, Issue 1, Pages 55-62 Demand forecasting for supply processes in consideration of pricing

Evaluating factor pricing models using high-frequency

Shadow Exchange Rate Factor (SERF) • Ratio of economic price of foreign currency to its market price. • Is generally greater than one • For economic analysis using the domestic price numeraire,

Theories of Product and Factor Pricing Perfect Competition

Factor Market Investopedia

This factor affecting land value is the sole most important factor which led to the development of various land price models in urban economics. 3. Neighborhood amenities: The cost of land is also affected by the availability of the facilities such as shopping areas, medical facilities, school, parks& playgrounds, and other basic need of the humans.

Arbitrage Pricing Theory APT – Investopedia

Testing for Alpha in Linear Factor Pricing Models with a

The theory explains the factor price determination during long run and it has failed to explain the short run determination of factor pricing. Professor J.M. Keynes has rightly pointed out that in the long run we all are dead and there is no economic problem. In such a …

Pricing Kernels Defined in Relation to Asset Pricing

The pricing kernel, or stochastic discount factor, is an important concept in mathematical finance and financial economics. The term kernel is a common mathematical term used to represent an operator, whereas the term stochastic discount factor has roots in financial economics and extends the concept of the kernel to include adjustments for risk.

Arbitrage Pricing Theory APT – Investopedia

Influence of Macroeconomic Factors on Prices of Real

Theory of Factor Pricing OR Theory of Distribution: Introduction to Theory of Factor Pricing or Theory of Distribution : The theory of distribution or the theory of factor pricing deals with the determination of the share prices of four factors of production, viz., land, labor, capital and organization.

Session 2.3 Financial Economic Analysis Shadow Pricing.ppt

Pricing factor of production – Download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online. Assignment of Economics, regarding pricing factor of production.

The Economics of Tacit Collusion Final Report July 16

Evaluating factor pricing models using high-frequency

Influence of Macroeconomic Factors on Prices of Real

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: The Behavior of Prices Volume Author/Editor: Frederick C. Mills

Equilibrium Asset Pricing and Discount Factors Overview

A factor market is a marketplace for the services of a factor of production. A factor market facilitates the purchase and sale of services of factors of production, which are inputs like labor

Factor price equalization Wikipedia

What Is Pricing Policy in Economics? Pricing policy refers to the way a company sets the prices of its services and products basing on their value, demand, cost of production and the market competition. Pricing policy is essential for all companies as it provides a guideline for creating profits and

Arbitrage Pricing Theory APT – Investopedia

Functions of the Price Mechanism Explained tutor2u Economics

In this equation, m t is the share price at time t, E(d t+τ) is the expected dividend per share for period t+τ, and r is (approximately) the long-term average expected stock return or, more precisely, the internal rate of return on expected dividends.

Theories of Product and Factor Pricing Perfect Competition

EQUILIBRIUM ASSET PRICING AND DISCOUNT FACTORS Cochrane, J. H., 1999b, “Portfolio Advice for a Multi-factor World”, Federal Reserve Bank of Chicago Economic Perspectives, 23, pp. 59—78.

Theory of Factor Pricing Meaning and Need Microeconomics

The Economics of Tacit Collusion Final Report July 16

Testing for Alpha in Linear Factor Pricing Models with a

Arbitrage pricing theory is an asset pricing model that predicts a security’s return using the linear relationship between its expected return and macroeconomic factors.

Factor price equalization Wikipedia

Theory of Factor Pricing Meaning and Need Microeconomics

This factor affecting land value is the sole most important factor which led to the development of various land price models in urban economics. 3. Neighborhood amenities: The cost of land is also affected by the availability of the facilities such as shopping areas, medical facilities, school, parks& playgrounds, and other basic need of the humans.

Pricing Kernels Defined in Relation to Asset Pricing

The statistical factors, f, and economic shocks, g, are equivalent if g = L -1 f for a nonrandom k×k matrix L. In this case, the obvious choice of rotation is f * = g.

J.F. Due and R.W. Clower Intermediate Economic Analysis

Pricing factor of production Capital (Economics

Three Types of Factor Models 1. Macroeconomic factor model (a) Factors are observable economic and financial time series 2. Fundamental factor model

Endowments Factor Prices and Skill-Biased Technology

Influence of Macroeconomic Factors on Prices of Real

Pricing Policies Considerations Objectives and Factors

Three Types of Factor Models 1. Macroeconomic factor model (a) Factors are observable economic and financial time series 2. Fundamental factor model

PDF Pricing the future The economics of discounting and

Three Types of Factor Models 1. Macroeconomic factor model (a) Factors are observable economic and financial time series 2. Fundamental factor model

Fundamental Economic Factors That Affect Housing Prices

Pricing Policies Considerations Objectives and Factors

J.F. Due and R.W. Clower Intermediate Economic Analysis

This factor affecting land value is the sole most important factor which led to the development of various land price models in urban economics. 3. Neighborhood amenities: The cost of land is also affected by the availability of the facilities such as shopping areas, medical facilities, school, parks& playgrounds, and other basic need of the humans.

Pricing Kernels Defined in Relation to Asset Pricing

Session 2.3 Financial Economic Analysis Shadow Pricing.ppt

Endowments Factor Prices and Skill-Biased Technology

Factor pricing is by the Austrian theory of imputation. To Austrians, all costs are opportunity costs. The fifth in a series of ten lectures, from Fundamentals of Economic Analysis: A Causal-Realist Approach .

MATH685Z – Mathematical Models in Financial Economics

Functions of the Price Mechanism Explained tutor2u Economics

Establishment and Application of Multi-Factor Pricing

Pricing methods in economics pdf Or indeed a definition for various types of pricing methods, the inadequacy of. pricing methods in business economics

Equilibrium Asset Pricing and Discount Factors Overview

Previous article in issue: Recursive utility using the stochastic maximum principle Previous article in issue: Recursive utility using the stochastic maximum principle Next article in issue: Euler equation estimation: Children and credit constraints We are grateful to a co-editor and two anonymous

EconPapers A five-factor asset pricing model

Factor price equalization Wikipedia

5. Pricing of the Factors of Production and the Labor

Factor price equalization is an economic theory, by Paul A. Samuelson (1948), which states that the prices of identical factors of production, such as the wage rate, or the rent of capital, will be equalized across countries as a result of international trade in commodities.

Fundamental Economic Factors That Affect Housing Prices

Pricing factor of production Capital (Economics

international differences in factor prices, and international patterns in the factor content of trade. Second, it explains each of these separately by factor (as is the standard sinceVanek(1968) and Leamer(1980)) and explains these for the ratio of skilled-to-unskilled labor.

Pricing Kernels Defined in Relation to Asset Pricing

J.F. Due and R.W. Clower Intermediate Economic Analysis

Department of Economics and Related Studies University of York Heslington York, YO10 5DD No. 17/04 Testing for Alpha in Linear Factor Pricing Models with a Large Number of Securities M. Hashem Pesaran Takashi Yamagata . Testing for Alpha in Linear Factor Pricing Models with a Large Number of Securities M. Hashem Pesaran Department of Economics & USC Dornsife INET, University of …

Testing for Alpha in Linear Factor Pricing Models with a

The pricing kernel, or stochastic discount factor, is an important concept in mathematical finance and financial economics. The term kernel is a common mathematical term used to represent an operator, whereas the term stochastic discount factor has roots in financial economics and extends the concept of the kernel to include adjustments for risk.

Establishment and Application of Multi-Factor Pricing

Equilibrium Asset Pricing and Discount Factors Overview

Testing for Alpha in Linear Factor Pricing Models with a

When using this method it’s important to factor in all your business costs and not overlook taxes, a wage for yourself, superannuation and leave entitlements. Competition-based pricing strategies. There are a number of competition-based pricing strategies you can employ when setting your prices. Going rate pricing . This can be useful in situations where there is a clear price leader in the

Endowments Factor Prices and Skill-Biased Technology

Equilibrium Asset Pricing and Discount Factors Overview

Fundamental Economic Factors That Affect Housing Prices salaries of construction workers, and other material costs, which in turn influences the expected housing prices.

Influence of Macroeconomic Factors on Prices of Real

EconPapers A five-factor asset pricing model

Factor price equalization Wikipedia

Factors of production is an economic term that describes the inputs used in the production of goods or services in order to make an economic profit. They include any resource needed for the

Evaluating factor pricing models using high-frequency

EconPapers A five-factor asset pricing model

Theory of Factor Pricing Meaning and Need Microeconomics

A factor market is a marketplace for the services of a factor of production. A factor market facilitates the purchase and sale of services of factors of production, which are inputs like labor

Establishment and Application of Multi-Factor Pricing